Commentaries (some of them cheeky or provocative) on economic topics by Ralph Musgrave. This site is dedicated to Abba Lerner. I disagree with several claims made by Lerner, and made by his intellectual descendants, that is advocates of Modern Monetary Theory (MMT). But I regard MMT on balance as being a breath of fresh air for economics.

Saturday, 31 October 2015

Sectoral balances don’t explain anything – what of it?

In response to David Graeber’s recent article on sectoral balances, Ann Pettifor seems to be worried that people will take sectoral balance analysis as being the EXPLANATION for changes in flows of money between different sectors, as distinct from being simply a statement or quantification of those flows.

I agree with Scott Fulwiller's response to Pettifor, namely that I’ve never actually known anyone make that mistake.

The balance sheet of a firm or corporation doesn’t EXPLAIN anything. But balance sheets are nevertheless useful snapshots of the total assets and liabilities of a firm or corporation at a given moment in time.

Friday, 30 October 2015

No such thing as the natural rate of interest?

According to Steve Keen there is no such thing as the natural rate of interest. As he puts it “it is a fantasy: there is no such thing.”

What: so if I shop around for a loan I’ll find the rates offered jump around all over the place between plus 50% pa and minus 20% - or something?

My guess is that I’ll find every bank I apply to will make a roughly similar offer, and far as I’m concerned, that’s the natural rate as of 2015, or at least something quite close to the natural rate.

To be more accurate, my definition of the natural rate of interest on a near zero risk loan (or any other level of risk you care to choose) is the rate that prevails at a particular point in time assuming government is not artificially interfering with the rate.

Of course what constitutes “artificial interference” is a tricky question. Certainly I’d classify borrowing so as to fund CURRENT spending as opposed to capital spending as a form of artificial interference.

As to whether governments ought to borrow so as to fund CAPITAL spending, that’s more debatable. But assuming it can be demonstrated that GDP is maximised by having government borrow so as to fund capital spending (or not), and assuming government complies with that “demonstration”, then the prevailing rate of interest for a loan of any given level of risk is the “natural rate”.

Can’t see the problem IN PRINCIPLE with that “natural rate” idea. As to actually quantifying it, that's tricky because of the above difficult argument about whether and how much government ought to borrow, plus of course government is a very large borrower.

Pro immigration nonsense.

There must have been a thousand articles written over the last ten years telling us that one argument for immigration is that immigrants (who tend to be young) can help rectify the demographic “aging” problem in the West.

The first blindingly obvious flaw in that argument (well, blindingly obvious to anyone with an IQ above three) is that immigrants are human beings (surprise surprise) and like other human beings they eventually grow old. And that means yet more immigrants.

Thus using immigration to any great extent to deal with the aging problem results in an exponential increase in the population. And the actual extent of the population increase there is catastrophic. Several studies have been done into the size of that population increase, and it turns out that if immigration alone is used to deal with the aging problem, the population doubles every fifty years or so.

Another blindingly obvious flaw in the “import young immigrants” argument has always been that improved nutrition and medicine in less developed countries will result in those countries THEMSELVES having an aging problem.

And what d’yer know? China has just announced an end to its one child policy. Lefties will be amazed. Anyone with a brain will be yawning.

So what solutions can we expect from leftie journalists to China’s aging problem? I know: it’ll be “import youngsters from the West”.

Please, please: how do I get paid for writing BS?

Thursday, 29 October 2015

Money creation by private banks involves an element of counterfeiting.

The free market or GDP maximising rate of interest is achieved in the same way as the free market or GDP maximising price of apples is achieved: potential buyers of the commodity (borrowed funds or apples) bid for the commodity, and producers produce whatever quantity they want or find profitable. Buyers and sellers reach a compromise known as the “market price”.

In a simple economy where just gold coins were used as money, there is no reason to think gold coin money would prevent the optimum rate of interest and debt being achieved.

Moreover, (and keeping it simple – at least to start with) if private banks operated in this hypothetical simple economy, and those banks confined themselves to intermediating between borrowers and lenders, there is again no reason to think the optimum rate of interest and debt would not be achieved.

However, in the real world, commercial banks do something else apart from simply intermediating: when worthwhile looking potential borrowers apply for loans, banks can simply credit borrowers’ accounts with money produced from thin air. (London goldsmiths 300 years ago issued receipts for non-existent gold). Indeed, if the prevailing rate of interest for a near risk free loan is say 5%, and a potential borrower can pay only 4%, that’s no problem for the bank. The bank can just lend at 4% instead of 5%. After all, it costs the bank nothing to do a simple book keeping entry: credit the account of the borrower with £X.

As Joseph Huber and James Robertson put it in their publication “Creating Money”, “Allowing banks to create new money out of nothing enables them to cream off a special profit. They lend the money to their customers at the full rate of interest, without having to pay any interest on it themselves.”

Term accounts.

It’s arguable that when a bank creates $Y and lends it out that the money supply does not necessarily rise by $Y: reason is that the RECIPIENTS of that money (once the borrower has spent it) may put it into term accounts where access takes longer than two or three months. And standard practice around the world is not to count so called money is such term accounts as money.

That doesn’t actually make much difference to the basic argument here. For example even if all of that money goes into term accounts, there will still be an inflationary effect when the money is initially spent. Plus chances are that while SOME OF the new money goes into term accounts, some will also go into current accounts (“checking accounts” in US parlance).

There’s no free lunch.

The process via which banks lend out money produced from thin air sounds too good to be true, and it is. That is, there might seem to be a free lunch here, but there isn't.

Assuming the economy is already at capacity, money which is effectively printed by private banks and loaned out will be spent. And that’s inflationary.

That in turn means government or the central bank has to rein in aggregate demand somehow, e.g. by raising taxes or cutting public spending. Thus the bank and borrower who has been supplied with money produced from thin air effectively steal from taxpayers and/or those who benefit from the latter government spending (e.g. road users, teachers, doctors, their patients, etc).

Counterfeiting.

The money printing activities of private banks are not EXACTLY the same as backstreet counterfeiters who print illicit $100 bills or £50 notes, and then spend that on smart cars, houses, holidays etc. That would be too obviously a form of fraud or theft, and banks have to be MODERATELY subtle when it comes to skulduggery.

However, the money produced by private banks goes into general circulation just like the money produced by backstreet counterfeiters and both types of money are inflationary for reasons given above. Thus state produced money has to be withdrawn to make room for counterfeiter’s money. So there is SOME SIMILARITY between what backstreet counterfeiters do and what private banks do. Plus their activities result in a rate of interest which is below the GDP maximising rate, and an amount of debt which is ABOVE the GDP maximising or optimum amount.

George Selgin.

Another explanation as to how private money displaces public money is set out by George Selgin in this article, which is not to suggest he would agree with everything in this article of mine. Indeed he argues that privately created money IS NOT inflationary, which might seem to contradict this article of mine.

What Selgin actually says is that given a “public money only” system (like the gold coin economy above) and assuming a private bank or banks set up in business, the result will be inflation: inflation which will continue till the value of the stock of public issued money has been reduced to near nothing.

That’s not much different to my point above namely that the appearance of private banks has an inflationary effect: I just assumed that the state deals with that by withdrawing public money rather than by letting inflation rip, which is what Selgin assumes. Thus my portrayal of how private money displaces public money is not actually much different to Prof Selgin’s.

Private bank created money is inefficient.

Another fundamental flaw with privately created money is that it is inherently expensive to produce compared to central bank or state issued money, and for the following reasons.

In a hypothetical economy where people (understandably) want a form of money, but did not want to borrow, private banks could easily issue whatever amount of money people wanted: people would just deposit suitable amounts of security, and banks would credit peoples’ accounts as required. But checking up on the value of security (and houses are much the most common form of security) does require several hours work by skilled bank staff, and that costs.

In contrast, simply having the state create and spend money into the private sector whatever amount of money is needed to keep the economy ticking over at capacity or “full employment” costs next to nothing.

As Milton Friedman put it, “It need cost society essentially nothing in real resources to provide the individual with the current services of an additional dollar in cash balances.” (That’s from Ch3 of his book, “A Program for Monetary Stability”.)

Thus even though privately issued money is inherently inefficient compared to state issued money, privately issued money manages to displace publically created money.

Wednesday, 28 October 2015

David Graeber on sectoral balances.

There have been numerous references on Twitter to this recent article by David Graeber, so I thought I’d have a look. His basic argument leaves room for improvement. The argument runs thus.

He starts by introducing the basic sectoral balance idea with the assistance of the chart below. That’s the idea that if the economy is split into different sectors, like “public sector” “private sector” etc, then money flowing OUT OF one sector must flow INTO another. Thus outflows must equal inflows. And it’s good to see that basic idea being introduced to general public, so congratulations go Greaber for that.

He then tries to extend that idea to DEBT. He tells readers that if government runs a surplus (i.e. there’s a flow of money FROM the private sector TO THE public sector) the result must be an increase in private sector debt. As he puts it, “If the government pays off its debt, what it’s basically doing is transferring that debt directly to you, as mortgage debt, credit card debt, payday loans, and so on.” Whaaaat?

If the private sector has a stock of money (base money to be exact) and £Xbn of that flows into public sector coffers, there is no need whatever for private sector debts to rise by £Xbn or even any need for them to rise at all. All that happens is that the private sector’s stock of money falls by £Xbn.

No doubt if government (to keep it simple) placed a £Y per week poll tax on every adult there would be a TENDENCY for some people to run into debt. So in that case, a government surplus would indeed result in a finite rise in private sector debts.

On the other hand, the TENDENCY is for the better off to pay more tax, and where that’s the case there could be very little rise in private sector debts as a result of a government or public sector surplus.

Certainly, Graeber is going a bit far when he says “If the government pays off its debt, what it’s basically doing is transferring that debt directly to you…”.

It is correct to say that if government pays off £Z of debt, then private sector paper assets will fall by £Z. But as to how far private sector debts rise as a consequence, that’s hard to say without looking a numerous details, like what sort of tax increases are used to bring about the latter government surplus.

____________

P.S. (30th Oct). Bill Mitchell comments on Graeber's article in the second half of Bill's blog post. _

Monday, 26 October 2015

Why not insure everyone against losses on the stock exchange?

If you lend to a corporation that specialises in loans to mortgagors, small businesses etc (i.e. make a deposit at a bank) government guarantees you won’t lose out.

But if you lend to a corporation that does anything else, like making cars or computers (i.e. buy bonds in those corporations) then you’re on your own: there are no government guarantees.

What’s the logic there? I smell a rat.

One of the excuses given for taxpayer funded guarantees for those making deposits at banks is that it encourages saving and investment. Indeed the UK’s Vickers commission put just that argument (sections 3.20 – 3.24).

Also it could be argued that the purpose of state guarantees for bank deposits is to ensure that everyone has a secure method of storing and transferring money. Well unfortunately that argument won’t wash, for the following reasons.

If the sole purpose of state guarantees for bank deposits was achieve the latter “security”, that could be provided by the state. Indeed, in some countries it already is provided to some extent by the state in the form of state run savings banks (like National Savings in the UK).

In short, the purpose of guarantees or subsidies for bank deposits is quite obviously (as suggested by Vickers) to encourage loans and investments made by banks, AS WELL AS providing everyone with a secure way of lodging and transferring money.

So, back to the original question: why no state guarantees for those investing in the stock exchange (whether as individuals or via pension funds and the like). In particular, why no guarantees for those buying share or bonds on the stock exchange? After all, as Vickers and others so eloquently point out, government guarantees for people who lend encourages lending and investment.

A possible answer to the latter question is that those investing on the stock exchange DELIBERATELY take a risk, whereas those who deposit money in a bank are quite clearly aiming for total safety.

Well that’s just a circular argument: stock exchange investments are risky because they are not backed by the state (i.e. taxpayers).

Not for the first time, the logic behind the conventional wisdom is nonsense.

Friday, 23 October 2015

Raise interest rates because in the past they were higher.

I’m getting tired of the argument that interest rates must be raised because in the past, they were higher. This Financial Times article is the latest example of the latter argument.

To be exact, the “17th Geneva Report, commissioned by the International Centre for Monetary and Banking Studies” has according to the FT article “urged governments to use fiscal policy.....to boost investment and raise long-term interest rates” so that come the next recession, interest rate cuts can help deal with the problem.

Well as MMTers have explained, government doesn’t need to pay interest on its debt unless the private sector holds more of such debt than it wants at a zero rate of interest (and zero interest debt more or less equals base money). Thus monetary policy (i.e. adjusting interest rates) is not possible unless there is first an excess amount of fiscal stimulus (i.e. “government borrows and spends and/or cuts taxes”). So a regime where interest rate adjustments are possible is like controlling the speed of a car by having the accelerator (fiscal policy) permanently on the floor, while the car’s speed is adjusted using the brake (monetary policy).

If you’re starting to giggle, so am I. But I’ll continue.

If we ignore the excess CO2 emitted and wear on the brakes and engine that would result from that style of driving, that style COULD MAKE SENSE if the brake is better at fine tuning the car’s speed than the accelerator. Likewise, interest rate adjustments could make sense if they are better at fine tuning. But there doesn’t seem to be evidence that interest rate adjustments actually ARE BETTER at fine tuning. Indeed, several studies show that interest rate adjustments are NOT TOO GOOD at adjusting demand. Thus it’s not clear why there should be a big hurry to revert to “normal” monetary policy, i.e. trying to raise interest rates again.

The exception to that is perhaps the US where anything resembling fiscal policy flexibility is impossible because Congress spends a full year arguing before any change can be made to tax or government spending. However, in most other countries, dispensing with interest rate adjustments and relying just in fiscal adjustments should be possible.

The above Geneva Report also claims that low interest rates encourage asset price bubbles. Well the big problem with that argument is that interest rates have been equally low over the last ten to fifteen years in Germany, Switzerland and Japan, yet according to the Economist House Price Index, there’s been no house price bubble in those countries at all.

Thursday, 22 October 2015

Krugman criticises peoples’ QE.

I have a huge respect for Paul Krugman. His articles are always brief, to the point, and logical.

He normally sets out the core issues in any argument in a hundred words or less, as compared to numerous other economists who employ thousands of words, often failing to even get to the root of any argument.

This article of his deals with what is sometimes called “peoples’ QE”, i.e. having the state simply print money and spend it in a recession, rather than having the state borrow money first, and then print money and buy back the bonds issued (i.e. QE).

He starts by assuming the central bank is part of government. That’s a not unreasonable assumption: one that MMTers often make. As Krugman puts it, “It doesn’t take fancy analysis to make this point — just an acknowledgement that in financial terms, at least, the central bank is part of the government.” (That’s why I used the term “state” above – a word intended to refer to government and CB combined.)

Krugman continues (I’ve put his words in italics):

"So, compare two cases. In case 1, the government runs a budget deficit, which it finances by selling bonds to banks (it could be anyone, but let’s assume that banks are the buyers.) At the same time, the central bank — an arm of the government — is engaged in quantitative easing, buying bonds from banks with newly created monetary base.

I think we’re all agreed that the second part of this story isn’t very effective in a liquidity trap; the limitations of QE are why we’re even talking about helicopter money.

But now consider case 2, in which the government pays for deficits simply by “printing money”, that is, adding to the monetary base.

How do these cases differ?

At the end of the day, the government’s financial position is exactly the same: debt held by the private sector is the same, and so is the monetary base. The private sector’s balance sheet is the same too. The only difference is that in case 1 banks briefly hold some government bonds, before selling them back to the government via the central bank. Why should this matter for, well, anything?"

Well there’s nothing much I disagree with above. In particular I agree that “balance sheets are the same”. However, I suggest there are two significant differences between the two scenarios.

First, assuming the point of “print and spend” or “borrow and spend” is to impart stimulus, what on Earth is the point of borrowing? It’s pointless because the effect of borrowing is anti-stimulatory. I.e., as I’ve pointed out numerous times, to make borrowing a part of any sort of stimulus exercise is like throwing dirt over your car before washing it.

Also, the mere fact of borrowing creates jobs for a swarm of Wall Street and City of London paper pushers who receive huge salaries for doing nothing of any significance. (That’s just one example of a point made by Adair Turner, namely that much of what banks do is “socially useless”).

Politicians don’t understand government debt.

Second, a large majority of politicians (and a significant proportion of so called “professional” economists) equate government debt with household debts. That is, they think that government debt must be kept within limits for the same reason as a household or firm has to be careful of how much debt it incurs.

And that leads to the absurdity of Congress placing artificial limits on the amount of debt government can incur, which in turn means the US government machine periodically closes down, and/or unemployment stays at an artificially high level.

Conclusion.

So all in all, while Krugman’s points about balance sheets are correct, I suggest there are significant benefits to be had from PQE, as opposed to having government fund its spending via borrowing, with relevant bonds then being bought back by the central bank.

Wednesday, 21 October 2015

Does the state make seigniorage profits when it prints money?

That’s a nice simple exam question. My answer for what it’s worth is as follows.

If the state prints money and does helipcopter drops, the state gains nothing. All that happens (at least initially) is that the private sector’s paper assets rise in value.

If the state prints money and and that money just boosts CURRENT public spending (e.g. hiring more state employed bureaucrats), then again the state gains nothing. There are no seigniorage profits there.

A third possibility is that the state prints money and purchases items of a CAPITAL nature, e.g. roads, bridges, etc. In that case the state’s assets do rise in value, so there are seigniorage profits there.

Tuesday, 20 October 2015

High government debt does not stop government borrowing more.

The Hutchins Center (which seems to be part of the Brookings Institution) has a series of articles which purport to explain some basic economic problems. In one article entitled “The Hutchins Center Explains: Debt and Deficits” and under the sub-heading “Is debt at 74% of GDP a problem?” they claim that when the debt is at about that level it may be difficult for government to borrow more. As they put it:

“However, no one really knows at what level a government’s debt begins to hurt an economy; there’s a heated debate among economists on that question. Many economists think that more private borrowing will be crowded out if the government’s debt remains this large as the economy strengthens. Debt at this level, though, does limit the amount of flexibility the U.S. government has if it confronts another financial crisis or a deep recession and wants to borrow heavily, as it did during the Great Recession. It probably would be hard to add another 35 percentage points of GDP (or $5.7 trillion) to the national debt.”

Well excuse me, but if a lot more stimulus is needed and government wants to borrow a lot more, then clearly if it simply borrowed a lot more and left it at that, then interest rates might rise, and private investment could be crowded out.

But assuming the central bank AGREES that more stimulus is needed, it’s not going to let interest rates rise, is it? That is, it will simply print money and buy back some of those government bonds with a view to making sure interest rates DON’T RISE. In fact the central bank may even CUT RATES.

So what’s all this about “crowding out”? It’s all nonsense.

Murphaloon shifts his ground on PQE.

Several people have tried to explain to Richard Murphy (affectionately known as “Murphaloon” in some quarters) that infrastructure projects cannot for the most part be just turned on to deal with recessions, and then turned off again when the recession has passed. In addition, in the particular case of the UK, relevant skills just aren’t available. Up to now, getting those points into his head has seemed impossible.

However, in his latest post he seems to be talking about using peoples’ QE to build more houses in London over the next TEN YEARS.

Well that’s a totally kettle of fish. If the UK’s house building efforts are GRADUALLY increased over ten years, that gives time to train people. Plus that ten year program is clearly not to any great extent designed to deal with recessions, which normally last three to five years.

Sunday, 18 October 2015

Dramatic fall in loans as % of deposits at US banks.

The chart is from this Wall Street Journal article.

Basically this just reflects QE, I assume. In a system where (to take the extreme) commercial banks had no reserves, then loans would equal deposits. In contrast, where the central bank feeds $X of base money into the private sector by whatever means (QE or public spending funded by the printing press), then there will be $X of deposits unmatched by loans.

The only thing that puzzles me is why the fall in the loans/deposits ratio has leveled off in the last two years or so: after all QE in those years continued at about the same pace as in earlier years didn’t it?

Permanent zero rates would not be a disaster.

This Financial Times article claims that if zero rates still prevailed come the next recession, that would be a disaster because central banks would not be able to cut rates with a view to imparting stimulus. Actually various economists, including Milton Friedman, have advocated permanent zero rates.

My response to the FT article in the comments after the article was as follows.

The above article claims that “At that point, the world economy would be on the precipice of disaster….”. Oh la la: what are we going to do, children?

This is a problem which most advocates of Modern Monetary Theory find about as difficult as making a cup of instant coffee. For those not acquainted with MMT thinking (which isn't much different from Keynes’s thinking), here is what I’m 95% sure is the standard MMT answer to the problem. (I’ve had conversations with other MMTers almost every day for the last five years, so I’ve a pretty good idea what they think.)

1. Government / the state owns a device called the “printing press”: it can print and spend any amount of money it wants anytime, as Robert Mugabe demonstrated. (Curiously numerous so called “professional” economists seem to be unaware of the fact that the state owns a printing press, but then ignorance is common among economists.)

2. Instead of increased spending, the state can always increase its “net spending” by cutting taxes rather than by increasing public spending. Obviously that’s the option that right of centre governments tend to implement.

3. Going as far as Mugabe is clearly undesirable, however printing and spending enough to bring full employment is clearly desirable.

4. The state can if it wishes print and spend so much that the resulting excess demand has to be reined in via artificially increased interest rates. To implement excess demand, and then cancel some of it via increased interest rates is arguably a strange thing to do, however there may be arguments for doing that. Personally I don’t think there are, i.e. in common with one of the leading MMTers, Warren Mosler, I favor permanent zero rates. Milton Friedman in 1948 also advocated a permanent zero rate (i.e. no government borrowing).

5. The main obstacle to bringing about full employment is a collection of economic illiterates known as “politicians” who seem to be under the illusion that the state needs to borrow before it can spend. (Back-street counterfeiters would split their sides at the idea that someone in possession of a printing press needs to borrow money.)

6. So in the event of interest rates still being at zero come another recession, far from that being a “disaster” as the above article suggests, there is no problem in principle whatever: all we do is use the printing press to increase public spending net of tax.

Thursday, 15 October 2015

Obama on Peoples’ QE.

As I’ve explained a hundred times, the big problem with PQE (assuming relevant spending is on infrastructure, and that seems to be the objective) is that not many infrastructure projects are shovel ready. I.e by the time they get going, the recession may have ended, and worse still we might be in the middle of the next boom.

So it’s good to see Barak Obama repeating that point. As he put it, “Infrastructure has the benefit of for every dollar you spend on infrastructure, you get a dollar and a half in stimulus because there are ripple effects from building roads or bridges or sewer lines. But the problem is, is that spending it out takes a long time, because there’s really nothing -- there’s no such thing as shovel-ready projects.” (H/t to Conversable Economist).

Of course Obama was not necessarily referring to infrastructure funded by having the state "print and spend" as distinct from "borrow and spend followed by QE". But those two amount to the same. So that's a near irrelevant difference.

But be warned: you don’t want to mention that weakness in PQE on the blog of one of the UK’s most vociferous advocates of PQE, namely Richard Murphy. Murphaloon, as he is affectionately known in some quarters, doesn’t like anyone pointing to problems with PQE: in fact such people are liable to be banned from commenting on his blog.

And (also for the hundredth time) I’m not saying we don’t need more infrastructure. The point is that (particularly in view of the shortage of relevant skills), if we’re going to increase that sort of spending, we need to build up such spending over a few years. The only people who think infrastructure spending can be doubled in ONE YEAR live in la-la land.

I.e. so far as counter cyclical spending goes, CURRENT spending tends to be more suitable than CAPITAL spending.

Wednesday, 14 October 2015

Why do banks pay interest to depositors?

The second tweet below prompts me to answer the above question.

@PositiveMoneyUK Banks don't create money. Read this to find out why: https://t.co/asO82p1Yfd pic.twitter.com/oAuwHHfl21

— Mike Ralph King (@MikeKingWriter) October 14, 2015

Mike King (above) suggests that banks rent money from depositors. My answer is that, strictly speaking, they rent SAVINGS, not money. I’ll enlarge on that.

Banks do two quite separate things, 1, create money for those who want money, and 2, intermediate between borrowers and lenders. Those two activities get very mixed up in the real world, but they can in fact be separated. E.g. in a hypothetical economy where no one wanted to borrow or lend, i.e. where debt didn't exist, it would be perfectly feasible for banks to create money without creating debt. See here for more on that:

In that hypothetical scenario, banks would charge for ADMINISTRATION COSTS involved in creating money. But there'd be no point in their charging INTEREST. Any bank depositor demanding interest would told to get lost.

Quite distinct (in principle) from that money creation activity, a second bank activity is intermediating between borrowers and lenders. Lenders do not normally lend without being rewarded for doing so (though at present, what with low interest rates, the reward is near non existent).

Ergo when it comes to intermediating, banks do indeed have to pay interest. But what they’re doing there is renting savings, not money. Indeed, relevant savers would for the most part be quite happy to have their money put into relatively long term “term” accounts where their savings / money was not available without two or three months’ notice. And normal practice in most countries is not to count the stuff in those term accounts as money.

In short, banks do not pay interest in order to obtain money: they pay interest in order to obtain savings.

Tuesday, 13 October 2015

Osborne, Wren-Lewis and budget deficits.

Like most people, I expect lies and drivel from politicians like George Osborne, the UK’s finance minister.

In particular, his idea about balancing the budget over the cycle is nonsense. I’ve explained the reasons several times in recent years, but it seems (for reasons set out below) that I need to explain yet again. Here goes.

Assuming we approximately hit the 2% inflation target, the REAL VALUE of the monetary base and national debt will shrink at about 2% pa. Thus assuming the debt and base are to remain about constant relative to GDP (which is what they actually do over the very long term), then both the base and the debt have to be constantly topped up. And there is only one way of topping them up: via a deficit.

Indeed, even more “topping up” is needed thanks to economic growth. That is, if the economy expands by X% and the debt and base are to remain constant relative to GDP, the clearly the debt and base have to expand by X% as well.

To illustrate that with some not unrealistic figures, if the debt and base are say 50% of GDP, real growth is 2%pa and inflation is 2%pa, then the deficit will have to be (2+2)%x0.5=2% of GDP. That’s quite a significant deficit.

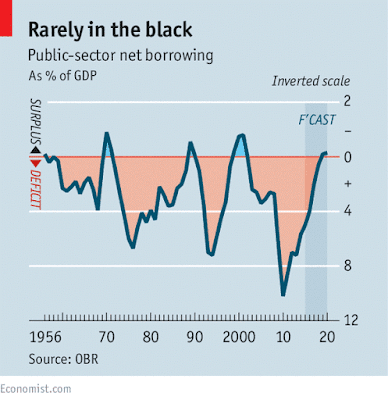

And if you don’t believe that, consider the fact that we have in practice had deficits about nine years out of ten since WWII. Plus the occasional year when there has been a surplus has nowhere near cancelled out the previous nine or so years of deficit.

(Chart thanks to The Economist)

So why am I repeating all this? Well seems that Simon Wren-Lewis (Oxford economics prof) agrees with the “balancing the budget over the cycle” idea. See his 5th para (starting “In this light…”) in particular. I suggest SW-L has slipped up there.

Having said that, I agree with him about 90% of the time and regularly read his blog posts: because they are thought provoking and interesting.

Monday, 12 October 2015

Dishonesty by the political left and right.

Lefties conflate or confuse two senses of the word “austerity”: 1, inadequate aggregate demand and 2, inadequate (at least in the eyes of lefties) public spending. That’s the equivalent of, and as dishonest as the right’s conflation of deficit reduction and public spending reductions.

Put another way, the left trumpets the virtues of increasing demand as cover for lefties’ attempts to raise public spending as a proportion of GDP. While the right trumpets the virtues of deficit reduction as cover for reducing public spending.

To be more accurate, the intelligentsia on both the left and right realise that trickery is involved. Meanwhile, the majority on both sides are fooled by the above “conflations”: that is, they don’t get the distinction between for example deficit reduction and public spending cuts.

Saturday, 10 October 2015

Pro-austerity incompetents.

Simon Wren-Lewis (Oxford economics prof) said here that concerns about the size of the deficit and rapidly increasing debt at the height of the crisis (around 2010) were “understandable”. I beg to differ.

First, it’s “understandable” that NON-ECONOMISTS should be concerned. After all, an individual person, household or firm gets into trouble when its expenditure exceeds income for too long, and excessive debts are incurred. However, those who HAVE STUDIED economics (and not even to degree standard) ought to be aware of the difference between microeconomics and macroeconomics: in particular they ought to be aware that household deficits and debts are not comparable to GOVERNMENT deficits and debts.

SW-L cites a list of twenty people (mainly economists) who were anti deficit (i.e. pro-austerity) in 2010. Those twenty wrote a letter to the Sunday Times in 2010 advocating austerity and SW-L says their mistake was “understandable”. Well I don’t agree: their “mistake” or rather incompetence was a disgrace to the economics profession. Those people should be removed from their jobs and given jobs to which they are better suited, like sweeping the streets. (I’ve listed them below).

But of course, an Oxford professor like SW-L can’t use language like that: professors have to be ultra-polite and couch any criticism of their peers in terms that are so anodyne that you’d hardly think criticism was involved at all.

That unfortunately results in incompetents remaining in their jobs.

The letter from the twenty so called “economists” starts thus.

“In the absence of a credible plan, there is a risk that a loss of confidence in the UK's economic policy framework will contribute to higher long-term interest rates and/or currency instability, which could undermine the recovery.

In order to minimise this risk and support a sustainable recovery, the next Government should set out a detailed plan to reduce the structural budget deficit more quickly than set out in the 2009 Pre-Budget Report.”

So to paraphrase, the authors claim that “loss of confidence” by the UK’s creditors might result in interest rates charged by those creditors rising, and it’s widely accepted that increased interest rates reduce demand, which of course would “undermine the recovery”.

Well the glaring flaw in that argument is that a country (like the UK) which issues its own currency has complete control of the rate of interest its government pays to borrow. That is, to reduce interest rates, the country’s central bank (CB) just prints money and buys back government debt. Indeed, and taken to the extreme, the CB can buy back the entire national debt which in a sense is what several countries have done over the last few years under the guise of QE.

To be more accurate, the US, UK and other countries have not bought back “the entire national debt”, but they HAVE BOUGHT BACK almost all the NEW DEBT issued or incurred in the last three years or so. So effectively, they haven’t borrowed at all: they’ve simply printed money and spent it (and/or cut taxes).

Thus the claim by the above twenty so called economists that a loss of confidence will cause a rise in interest rates is complete nonsense on theoretical grounds, plus it has turned out to be nonsense in practice.

Moreover, as both Keynes and Milton Friedman pointed out, having the state simply print money and spend it (and/or cut taxes) in a recession is a perfectly viable way of implementing stimulus: that is, it’s debatable as to whether it makes much sense for a government which prints its own money to borrow the stuff.

Printing money needn't cause inflation.

Of course whenever the words “print” and “money” appear in the same sentence a number of economically illiterate economists and others who have not studied economics appear from the woodwork chanting the word “inflation”.

And the answer to that point (as I and others have pointed out a thousand times) is that increasing the money supply is not inflationary unless it results in excess demand, as explained by David Hume over 200 years ago.

Foreign exchange markets.

Now let’s consider the “currency instability” to which the twenty so called economists referred.

Clearly if just ONE COUNTRY like the UK ran a relatively large deficit, then confidence in its currency might deteriorate. But the reality is that a very large “other country” was doing the same in 2010: the US. That greatly reduces any possible fall in value in the pound.

But even if the US had not been doing the same thing at the same time, why exactly would there be a reason to think the pound would fall in value? After all, the only purpose of a deficit is to maintain demand at a level that brings about full employment. EXCESS DEMAND would draw in excess imports which would hit the value of the pound, but enough demand just to bring about full employment would not draw in any more imports that full employment brought about by other means.

Credible plans are nonsense.

The latter point about the purpose of a deficit (or surplus) being to maintain full employment leads nicely to the next point which is that “credible plans” of the sort advocated by the twenty so called economists to reduce (or increase) deficits are a complete nonsense: they’re a contradiction in terms. That is, since the purpose of a deficit is to counteract any shortfall in demand, and since the extent of future shortfalls is not predictable, it’s a complete nonsense to have any sort of “credible plan” as to what the deficit will be at any point in the future.

That is, in two years time, consumer and business confidence might suddenly increase, as a result of which demand would rise. So in consequence, a smaller deficit, or even a surplus would be called for.

That is why Keynes said, quite rightly: “Look after unemployment, and the budget will look after itself”. That is, the only “credible plan” should be to attempt to use the deficit / surplus to keep the economy at full employment. In contrast, the size of the deficit / surplus is simply a number that comes out in the wash. It should be ignored.

The final nail in the coffin.

Of course the proof of the pudding is in the eating: i.e. have continued deficits since 2010 actually brought about “currency instability” or “higher interest rates”? No they haven’t!!!

In short, those twenty so called economists (listed below) are incompetent. Their mistake was not “understandable”. They should be put onto sweeping the streets.

The twenty incompetents.

Orazio Attanasio, University College London; Tim Besley, LSE; Roger Bootle, Capital Economics; Sir Howard Davies, LSE; Lord Meghnad Desai, House of Lords; Charles Goodhart, LSE; Albert Marcet, LSE; Costas Meghir, UCL; John Muellbauer, Nuffield College, Oxford; David Newbery, Cambridge University; Hashem Pesaran, Cambridge University; Christopher Pissarides, LSE; Danny Quah, LSE; Ken Rogoff, Harvard University; Bridget Rosewell, GLA and Volterra Consulting; Thomas Sargent, New York University; Anne Sibert, Birkbeck College, University of London; Lord Andrew Turnbull, House of Lords; Sir John Vickers, Oxford University; Michael Wickens, University of York and Cardiff Business School.

Friday, 9 October 2015

Charles Goodhart finds flaws in full reserve banking?

Patrizio Laina wrote a very good summary of the history of full reserve banking (FR) here (pages 1-19). That is followed by a paper entitled “A Commentary on Patrizio Lainà’s ‘Proposals for Full-Reserve Banking’…” by Charles Goodhart and Meinhard Jensen (p.20 onwards).

The first weakness in that commentary is that it’s a commentary on the FR idea, not (as per the title) a commentary on Laina’s work which to is largely an impartial historical record of thinking on FR. That is, Laina does not take sides on the actual pro FR versus anti FR argument. Thus comments by Goodhart and Jensen on the historical accuracy of Laina’s points would be in order (if the objective if G&J’s paper is as per its title). In contrast, comments on the pros and cons of FR are not in order.

So that’s the first flaw in G&J’s paper. But never mind: let’s continue with the paper.

Their first criticism (p.21) alludes to the separation of lending from deposit accepting and the authors say:

One of the reasons sometimes put forward by Currency School advocates (i.e. FR advocates) for this separation, though not emphasised by Lainà , is the claim that money creation should be a State monopoly, so that having much of such creation done by private sector banks is, in some senses, an inappropriate transfer of seignorage from the public sector to private sector bodies. A problem with this position is that many of these same economists would probably also endorse the (invalid) Karl Menger theory of the creation of money as a private sector market response to the constraints of bartering, in which story the government only plays a subsidiary role. Holding both positions simultaneously would seem to be logically inconsistent.

Well the first point to note there is that G&J specifically say they are dealing with a point “not emphasised” by Laina. My point exactly: G&J in their paper criticise FR, not Laina’s paper.

Anyway, moving on… I’m baffled by G&J’s claim that advocates of FR are keen on the idea that money exists or arose out of a desire to do away with the inefficiencies of barter.

Of course, money certainly does do away with the inefficiencies of barter, but there is plenty of dispute (as G&J rightly suggest) over whether centuries ago money arose from that desire, or whether it arose mainly from other causes, like the desire to kings and rulers to have a more efficient method of collecting taxes.

However, having read well over a million words written by the advocates of FR, it’s news to me that they’re all that concerned about that historical dispute. Quite the contrary: advocates of FR simply take the existing money and bank systems as they are, and argue that we can do better.

Rules for determining stimulus.

Next (2nd half of p.21) G&J claim that advocates of FR are concerned (unsurprisingly) as to how stimulus should be determined. And according to G&J there is much dispute between advocates of FR as to what rule or set of rule should be used.

Well there’s an easy answer to that: there’s plenty of dispute, including heated dispute, between advocates of the existing bank system as to how stimulus should be determined! For example there is plenty of dispute as to how effective interest rate adjustments are. Plus there is plenty of dispute at the time of writing over exactly when central banks should raise interest rates. Monetarists argue with Keynsians, who argue with market monetarists, who argue with Austrians. The list is almost endless!!!

And apparently (according to G&J) advocates of the conventional wisdom or the existing/conventional bank system “prefer discretion and flexibility” when it comes to determining stimulus.

Well one current lot of FR advocates (Positive Money, the New Economics Foundation and Prof Richard Werner) actually advocate very much the same degree of “flexibility” as advocates of the conventional wisdom in that they suggest stimulus under FR be determined by an independent committee of economists very much like the Bank of England Monetary Policy Committee which currently does that job. And that committee under the latter PM/NEF full reserve system would be entirely free (as is the BoE MPC) to use its best judgement in deciding on stimulus: if it went for a rules based system, I’d imagine PM and NEF would have no quarrel with that, and if they went for “flexibility” rather than rules, then as I understand PM and the NEF, the two latter organisations would be equally happy.

Banks will circumvent the rules.

Next, (top of p.23) G&J make a claim which has been made a dozen times before, namely that banks would try to circumvent the rules of FR.

So banks scrupulously obey the rules under the existing system? Anyone who thinks that is living in la-la land. G&J may not have noticed but banks have been fined over a hundred billion dollars in the US in the last two or three years for laundering Mexican drug money, fiddling Libor and numerous other crimes. And in the UK we’ve had the payment protection insurance scandal.

As for Dodd-Frank, the legislation in the US which is supposed to clean up banking, Prof John Cochrane in the opening sentence of a paper of his said “In recent months the realization has sunk in across the country that the 2010 Dodd-Frank financial-reform legislation is a colossal mess..”.

Or as Richard Fisher, former head of the Dallas Fed put it,“We contend that Dodd–Frank has not done enough to corral TBTF banks and that, on balance, the act has made things worse, not better. We submit that, in the short run, parts of Dodd–Frank have exacerbated weak economic growth by increasing regulatory uncertainty in key sectors of the U.S. economy. It has clearly benefited many lawyers and created new layers of bureaucracy. Despite its good intention, it has been counterproductive, working against solving the core problem it seeks to address.”

So when it comes to circumventing rules, which looks like being the worse: FR or the existing system? Well Dodd-Frank consists of a good 10,000 pages and counting (a lawyers’ paradise, as Fisher correctly observes). In contrast, the rules of FR can be written out on the back of an envelope. Those rules are basically just two in number. First, all money lenders must be funded by equity, not debt. Second, where depositors want their money to be totally safe, that money must be lodged in a genuinely safe manner or as safe a manner as possible: lodge the money at the central bank or in short term government debt.

And where rules are SIMPLE, then all else equal, they are easier to enforce. Thus the claim by G&J that banks would circumvent the rules under FR is weak in the extreme.

A small amount of circumvention doesn’t matter.

Next, it is not the aim of FR to ban all forms of private money creation. For example most advocates of FR don’t object to local currencies. Plus when it comes to small shadow banks there has to be some cut-off point or size of bank below which it is a waste of time trying to impose FR. Put another way, the important question is what the systemically important LARGE BANKS do.

Flexibility versus inflexibility (continued).

Next, G&J claim that “opponents of the Currency School” i.e. opponents of FR “believe that such rules will tend to be too inflexible, and quite often too deflationary”

Well the answer to that is that under FR (or least Positive Money and the New Economic Foundation’s version of FR) stimulus is determined in very much the same way as it is determined at present, that is (to repeat) by an independent committee of economists. If G&J want to claim that that committee gauges the amount of stimulus correctly under the existing system, but incorrectly under FR, then G&J need to explain exactly why (i.e. why the committee is likely to impose too much deflation). After all, there’s not much difference between the two systems in that under both systems, an independent committee of economists determines stimulus.

Then in support of their point, G&J quote Ann Pettifor as saying, “Linking all current and future activity to a fixed quantity of reserves (or bars of gold, or supplies of fossil fuel) limits the ability of the (public and private) banking system to generate sufficient and varied credit for society’s purposeful and hopefully expanding economic activity.”

That passage of Pettifor’s is riddled with mistakes. First, what’s all that about the quantity of reserves being fixed? Had Pettifor bothered actually reading the material published by Positive Money or other advocates of FR, she’d have discovered that reserves are FLEXIBLE, just as they are under the existing system. That is (to repeat) if the “independent committee” decides what stimulus is needed, then it creates new money (aka reserves) and government then spends that money into the private sector (and/or cuts taxes).

Second, she doesn’t distinguish (in the above passage or the surrounding text in her work) between credit granted by non-bank entities (e.g. trade credit) and the sort of credit created by and loaned out by banks, which might be described as “money-credit” or just “money”.

As to trade credit, there’d be nothing under FR to stop firms granting each other trade credit, and indeed the sums involved there are VAST. The amount owed to small and medium size firms in the UK is three times GDP (more than is loaned out by way of mortgages).

Third, it is nonsense to think, as Pettifor clearly does, that banks under the EXISTING SYSTEM can simply create credit-money willy nilly and lend it out. I set out the reasons here.

Fourth, I am not minded to attach much importance to what Pettifor thinks given that she seems to thinks we can spend limitless amounts on investments without anyone having to save or cut back on current consumption. For more on that, see here.

Fifth, returning to Pettifor’s idea that the amount available for loans by banks is rigidly fixed under FR, that idea assumes that for some strange reason the law of supply and demand doesn’t work when it comes to borrowing and loans.

That is, given a rise in demand for loans under FR, the rate of interest would clearly rise, which in turn would induce more people to put their money in accounts or entities devoted to granting loans (so called “investment accounts” under Positive Money’s system).

Now is there something wrong with the price of something rising (e.g. the cost of borrowing) when demand increases? Not that I can see. The rate of interest paid by mortgagors in the UK in the 1980s was nearly THREE TIMES the rate paid nowadays, but for some strange reason the sky didn’t fall in. Indeed, people in the 1980s actually paid off their mortgages quicker than today: caused no doubt to a greater or lesser extent by the rise in house prices in real terms in the intervening years.

Sixth, the sharp rise in demand for loans prior to the crises was not (as Pettifor seems to suggest) caused by a rise in investment in productivity increasing machinery or other innovations (her “purposeful and hopefully expanding economic activity.”) It was caused by house price bubble blowing.

Thus a rise in interest rates given increased demand for loans, as long as the rise isn't too much and too sudden, would seem to be entirely beneficial in as far as it thwarts house price bubbles.

That’s to be contrasted with the existing system under which when the private sector switches resources to bubble blowing from other forms of expenditure, central banks do NOT RAISE interest rates and on the grounds that aggregate demand and inflation do not seem to have risen – exactly what happened before the crisis.

The opponents of FR normally win.

G&J’s next criticism of FR is thus.

“Be that as it may, the Banking School may lose a few battles (as in 1844), but usually wins the war. One reason for this is that the monetary authorities like to maintain discretionary control, and do not much want to be constrained by the rules that academic economists propose. Per contra, academic economists generally prefer rules to discretion. Even Tobin flirted with narrow bank proposals. Besides the time inconsistency argument, economists can devise rules that provide ‘optimal’ welfare in the context of their own models which they naturally wish to proselytise.” (In 1844 in the UK, private banks were prohibited from issuing their own bank notes)

OK, but another and less impressive reason the “banking school . . . usually wins the war” is that it’s in the interests of banks to win it, and banks deploy HUGE RESOURCES to ensuring they win it (including wads of cash in brown envelopes sometimes euphemistically called “contributions to politicians election expenses” donated to politicians).

Indeed Laina makes that very point. As he put it, “Phillips added that bankers were against the Chicago Plan as it was seen to reduce their profits. They resisted any changes to the status quo, unless it could be demonstrated that the new system would be even more profitable. Whittlesey was pretty much of the same opinion as he saw that the proposal was opposed because free services of banks would no longer be free as well as bank owners would lose their main source of profits.”

Conclusion.

Well I’m only half way thru G&J’s paper and hopefully I’ve established that it is riddled with mistakes. Thus I am not minded to read the second half.

Thursday, 8 October 2015

Departing IMF chief tumbles to the merits to peoples’ QE.

Given that the IMF was advocating austerity at the height of the crisis, I’m not sure why anyone should pay much attention to IMF staff. But anyway, the outgoing chief economist at the IMF, Oliver Blanchard seems to have tumbled to the merits of peoples’ QE.

To judge from reports of his speech (I can’t find a transcript of the actual speech) and like many other advocates of PQE, he unfortunately seems to advocate spending the relevant money on infrastructure. That is, he hasn’t yet tumbled to the point that infrastructure spending is not a clever way of combating recessions, and for the blindingly obvious reason that while there are some infra projects that are shovel ready, it often takes years to get infra projects going. Plus stopping them before completion is normally pretty daft. Plus in the particular case of the UK, the requisite skills are not instantly available.

In short, “print and spend” is a perfectly viable way of dealing with recessions, as pointed out by Keynes in the early 1930s. However, the spending should be fairly widely dispersed, not concentrated on particular items like infra. Indeed Positive Money have long advocated "print and spend" with the spending being allocated to a fairly wide selection of items - at least certainly not concentrated on just one item like infra.

I’ve made the above point about in inappropriateness of infrastructure spending as a means to combat recessions about a hundred times. And doubtless I’ll have to make it another hundred times before so called “professional” economists understand the point.

Getting simple ideas into the heads of so called professional economists is often a bit like getting thru a two foot thick concrete wall with a jack hammer.

And that is not to suggest we shouldn’t spend far more on infra: perhaps we should. But if there’s going to be a big increase we ought to build up that increased spending level over a period of years.

Monday, 5 October 2015

The cost of funding a bank just via equity is the same as funding it just via debt.

Banksters have made a good job of persuading politicians and regulators that bank capital is more expensive than bank debt.

The argument behind that claim is all to alluring, and it’s thus. Shareholders get haircuts before other bank creditors when a bank has problems, thus shareholders demand a higher return that other bank creditors. And that leads to the inescapable conclusion that equity or capital is an expensive way of funding a bank, doesn’t it?

The flaw.

One way of demonstrating the flaw in the latter argument is to consider two banks which are identical except that one is funded entirely or almost entirely by equity, while the other is funded entirely or almost entirely by debt (i.e. deposits and/or bonds).

Now if the “capital is inherently expensive” argument is correct, then funding the “equity only” bank should be much more expensive than funding the “debt only” bank. In fact the cost of funding the two is exactly the same, and for the following reasons.

I’ll assume initially that the government of the country where those two banks are located wants to maximise GDP, and to that end, government rules out all forms of subsidy (except where there are good social justifications for a subsidy as is doubtless the case with kid’s education). That is, government offers no subsidy of any sort for banks or depositors in the form of rescuing banks with taxpayers’ money.

Now the risks run by a bank are determined ENTIRELY by the nature of its assets - e.g. are the assets dodgy NINJA mortgages or more conservative mortgages? So let’s say the chance of the value of those banks assets declining to say 90% of book value in any one year is 1:20. (Replace 90% and 1:20 with X and Y if you like algebra).

So in the case of the bank funded just by equity, there’s a one in twenty chance of the assets and hence the value of shares declining to 90% of their book value in any one year. (Incidentally I assumed there that the value of shares is determined JUST BY the value of the bank’s assets and not to any extent by the bank’s perceived prospects, a factor which in the real world obviously also influences share prices. However, the latter “prospect” factor is as likely to boost share prices as to depress them, thus ignoring “prospects” is not wildly unrealistic.)

Funding a bank just with debt.

Now for the bank funded just by debt.

In this scenario, it’s debatable as to what happens when the assets of the bank decline to 90% of book value: the bank might be tipped into insolvency or it might not. But to keep things simple, let’s say there’s a law stating that when assets fall below 95% of book value, that the bank must be wound up, and that in the specific case of our hypothetical bank, assets actually fall to 90%, so the bank is in fact wound up.

Now what do bank creditors get by way cents in the dollar? Well obviously they get 90 cents in the dollar (ignoring the cost of insolvency proceedings).

But 90 cents in the dollar was exactly what those shareholders ended up with when assets fell to 90% of book value! So the risks run by shareholders and debt holders in the above two hypothetical banks is the same!

Ergo the return those two types of bank funder (shareholders and debt holders) will demand is also the same!

How does that come to be?

Now that’s an odd result. Part of the explanation is that as a bank’s capital ratio falls from 100% to 0%, the nature of debt changes from genuine debt into equity.

To illustrate, where a bank is funded about 90% by capital and about 10% by debt, the chances of debt holders losing out are very small. Thus their so called “debt” is genuine debt: that is, there’s a near 100% chance they’ll get $Z back for every $Z they deposit at or lend to the bank.

In contrast, where a bank is funded say 1% by capital and 99% by debt, it’s a complete delusion to think that debt holders don’t run a risk. That is, debt holders have in effect become shareholders: that’s shareholders as in “someone who stands to lose a significant portion of their stake in a corporation when the corporation has problems”.

Let’s assume deposit insurance.

It was assumed above that government offers no assistance to depositors where a bank goes under. If we make the alternative assumption, namely that government runs some sort of FDIC type deposit insurance scheme, and if we assume that the insurance premium is realistic, that makes no difference to the above conclusion.

Reason is that if depositors are aware of the risks they run, and demand the correct return in compensation for that, then that return will be equal to the premium that the FDIC deposit insurance system would charge.

Saturday, 3 October 2015

Pro austerity pillocks.

It is important to remember that it’s not just the political right which has advocated austerity, i.e. rapid deficit reduction, since the crisis started. First, a large number of so called “professional” economists have advocated austerity. There’s a list of 20 of them here.

Most of the latter 20 subsequently backtracked.

Also the IMF and OECD attributed supreme importance to so called “consolidation”, i.e. cutting debts and deficits, at the height of the crisis.

Bill Mitchell has gone into IMF and OECD incompetence in some detail. Google the name of Bill’s blog “Billyblog” and IMF and OECD for details.

For more on this, see this article by Simon Wren-Lewis from whom I got the above two links.

Subscribe to:

Comments (Atom)