Commentaries (some of them cheeky or provocative) on economic topics by Ralph Musgrave. This site is dedicated to Abba Lerner. I disagree with several claims made by Lerner, and made by his intellectual descendants, that is advocates of Modern Monetary Theory (MMT). But I regard MMT on balance as being a breath of fresh air for economics.

Friday, 31 March 2017

Wednesday, 29 March 2017

Glossy report says EU needs “full and good quality employment”. No shit?

We’d never have worked that out for ourselves, would we, children? Plus of course the people of Greece and youths in Spain will be splitting their sides at the above – er – “insight”.

The orange paragraph on page 12 of the above taxpayer funded report contains more gems. (Other paragraphs and pages contain yet more gems, but I’ll concentrate on that one paragraph otherwise I’ll be here all week).

Apparently Europe needs “sustainable development”. Well you can guarantee the word “sustainable” will appear on every page of this sort of report.

Europe apparently also needs “balanced economic growth and prosperity”. Prosperity? Personally I’m in favor of poverty and starvation, but there you go.

We also need “social progress”. Well there again, I personally favor letting pensioners starve to death and sending children down coal mines, and I know of many who agree with me. So obviously there’s not much I have in common with the no doubt highly paid authors of this report.

Plus p.12 tells we need “scientific and technical advance”. Never in the world.! You learn something every day, don’t you?

Sunday, 26 March 2017

Private bank issued money is counterfeit money.

My Concise Oxford Dictionary (2004 edition) defines counterfeit as “made in exact imitation of something valuable with the intention to deceive or defraud.” The money created or “printed” by private banks clearly fits the above definition: the only question is just how close is the “fit”?

When obtaining a loan from a private bank, the borrower is told they have been loaned X dollars, pounds, etc. But those so called dollars etc are most definitely not the real thing. What the private bank lends out is not the country’s official central bank (CB) issued currency: it is certainly not legal tender. The proof of that is that when the borrower offers to pay someone for something using the so called money that the bank has loaned out, the potential payee is fully and legally entitled to refuse payment on the grounds that what is offered in payment is not legal tender.

Thus it is beyond dispute that there is a finite amount of “deception” there. What private banks ACTUALLY lend to borrowers is not dollars, but a promise by the bank to pay dollars. And that promise to pay itself is in effect a form of money which is quite widely accepted as money. But, to repeat, potential payees are entitled to turn it down, and sometimes do.

As to “made in exact imitation of something valuable”, well that’s a close fit as well!

It could be argued against the above “counterfeit accusation” that the accusation is very semantic or legalistic and hence that the accusation amounts to nothing if the counterfeiting doesn’t actually do any harm. That is a perfectly fair point. Thus the rest of this article is devoted to showing that the above counterfeiting does actually do harm.

Cheating the population at large.

The basic problem with traditional backstreet counterfeiters who turn out imitation $100 bills or imitation £10 notes is that they actually rob the general population. The reason is intuitively obvious even to those who have never read an introductory economics text book. But just to spell it out, the reason is as follows.

Assuming the economy is at capacity or “full employment” and a significant number of imitation $100 bills are produced and spent, that will raise demand. That additional demand will cause excess inflation given the above “at capacity” assumption. Thus the state has to take some sort of deflationary counter measure, like raising taxes and confiscating some of the private sector’s stock of base money. To illustrate, in a hypothetical economy where the only form of money was dollar bills and coins, for every counterfeit $100 bill that went into circulation, the state would have to confiscate one genuine $100 bill from the population. (BTW: “base money” is a common name for the above mentioned “official CB issued money”)

Now you’ll be horrified to learn that very much the same point applies to loans granted by private banks and for the following reasons.

Assuming, again, that the economy is at capacity, and private banks grant extra loans, the relevant money will be spent, which will raise demand. That will be inflationary, thus the state will have to take some sort of deflationary counter measure, like (is this starting to sound familiar?) raising taxes and confiscating some of the private sector’s stock of base money.

In short, assuming the economy is at capacity, when a private bank grants mortgage to Joe Bloggs, the bank and Joe Bloggs obtain a valuable real asset, which has been effectively stolen from the general population. The “counterfeit” charge is shaping up, wouldn’t you say?

Interest rate cuts.

The latter is of course a serious charge, but it could be argued in defence of private money creation that private banks in practice only lend more when the CB cuts interest rates. And the objective behind interest rate cuts is entirely laudable: the objective being to raise demand where demand is inadequate. Thus, so it might be argued, private money creation is justified.

Well the first problem there is that private banks do not lend more ONLY when CBs cut interest rates. That is, private bank lending varies even given constant CB rates. For example it is obvious from what went on in the 1800s when governments and CBs did little to control demand that booms and asset price bubbles, assisted by irresponsible lending by private banks, can take off all of their own accord. Unfortunately not much has changed since those days.

But even if lending by private banks is closely related to official CB interest rates, the whole idea that demand should be controlled by artificial adjustments to CB interest rates is badly flawed and for the following reasons.

1. Given a recession, there is absolutely no prima facie reason to assume the problem is inadequate borrowing and investment, rather than a deficiency in one of the other constituents of aggregate demand, like consumer spending or exports.

2. The basic purpose of the economy is to produce what people want: both the items they normally purchase out of disposable income, and the items supplied by government (e.g. education for kids). Ergo given a recession, the logical cure is to expand household incomes (e.g. via tax cuts) and raise public spending. (The revolving door brigade will of course be horrified at the suggestion that given a recession, Main Street should be given more spending power rather than Wall Street. The answer to that is that there is no better evidence that something is desirable than the fact that the revolving door brigade don’t like it)

3. Given a recession, there is no reason to suppose interest rates won’t fall of their own accord: witness the fact that interest rates have fallen dramatically over the last 25 years or so. Government interference in the free market is entirely justified where it can be shown that the free market is not functioning properly. Unfortunately, there have been next to no attempts by the economics profession to confirm that given a recession, interest rates will not fall to the extent that they would in a perfect market.

4. In contrast to the latter fall in interest rates, a properly functioning free market would actually implement the above mentioned increase in consumer spending, plus there is a VERY OBVIOUS and well known obstruction to that mechanism, as follows.

In a perfect market, and given a recession, wages and prices would fall, which would increase the real value of the monetary base, which in turn would increase household liquid assets, which would increase consumer spending. In effect, one of the free market’s cures for a recession is a helicopter drop. That mechanism is normally referred to as the “Pigou effect” after the economist, Arthur Pigou.

Unfortunately that mechanism is stymied in the real world because, as Keynes put it, “wages are sticky downwards”. I.e. wage cuts tend to result in strikes, if not political revolutions. But not to worry: if the real value of the monetary base cannot be increased by increasing the real value of each dollar of base money, an equally good alternative is to increase the value of the stock of base money by having the CB print more dollars and distribute them, e.g. via tax cuts or extra public spending.

To summarise, it is blindingly obvious that what is missing in a recession is “dollars for households and government spending departments”. In contrast, it is not at all obvious that interest rate cuts are a logical solution.

Ergo the potential justification for private money creation mentioned several paragraphs above, namely that that activity is “entirely laudable” if it results from CB interest rate cuts is now in tatters.

Ergo the initial charge against private money printing made above, namely that it amounts to counterfeiting seems pretty solid.

In other words it looks like the Scottish philosopher / economist David Hume had a point when he said in 1742 that private bank created money is counterfeit money (para II.III.4) The French Nobel laureate economist Maurice Allais said the same.

Saturday, 25 March 2017

OMG: Spanish central bank economist says there’s a “huge fallacy” in MMT.

Miguel Navascués has worked as an economist at Spain’s central bank for 30 years. He has just published an article entitled “The Huge Fallacy Of The Modern Monetary Theory…”. (Incidentally, it was Mike Norman’s MMT site that alerted me to Navascués’s article)

My confidence in Navascués’s professional competence was badly dented very shortly after starting to read the article when I came across this sentence: "It’s difficult to imagine that money issued by a private entity would be as universally well accepted as fiduciary money today."

Er - actually the majority of money in circulation is issued / printed by private banks, not central banks as the opening sentences of this Bank of England article explains. Indeed 97% is the percentage often quoted as the proportion of money which is privately issued, though that percentage has actually been significantly reduced since the start of QE.

Next, there is this passage (which I’ve put in green italics):

"Another “revolutionary” aspect of the MMT is that instead of the state issuing debt, this will be substituted by the simple flow of money between the Central Bank and the state. The state should not issue debt which becomes a fictitious burden, since its monetarisation would end that. The state has an account in the Central Bank, with a zero interest rate, which it can use to deposit money or take out funds and be in credit or in debt.

This is incredibly bold. Responsable citizens would always prefer the state to issue debt, for transparency reasons. Even if it’s just to watch the trend in the yield curve for different maturities and how it is accepted by creditors. One thing is for the state to have a liquid account with the Central Bank with a zero interest rate, and quite another that it is not transparent and takes money when and whenever it wants."

Now the idea that MMTers advocate that government should be able to “take money when and whenever it wants” is just absurd. MMTers make it perfectly clear that they are aware of the fact that excessive spending (i.e. excessive aggregate demand) leads to excessive inflation. The average ten year old has worked that one out.

Having said that, MMTers are actually a bit vague on EXACTLY what controls should be in place to keep demand as high as is feasible without causing excess inflation. In fact this work by Positive Money, the New Economics Foundation and Prof Richard Werner is much better in that regard. Incidentally the latter PM/NEF work advocates full reserve banking, but don’t be put off by that: the system those three authors advocate for controlling demand is equally suitable under the existing bank system (sometimes called “fractional reserve” banking).

Next, the first para of the above quote from Navascués’s article actually contains a self-contradiction, as follows. As he says, MMTers want to abolish or monetise the national debt (as did Milton Friedman, incidentally). And that is not difficult to do: it simply involves continuing to QE the debt until it’s all gone. As for any inflationary effect of doing that, that is easily dealt with by cutting the deficit or even running a surplus.

At least the latter procedure is “easy” so far as economics goes: in contrast, and as far as politics goes, it might not be so easy. That is the “QE the entire debt” might have to be done over a ten year period so as to avoid excessive tax increases or public spending cuts. But there is no question but that the entire national debt can be abolished / monetised.

The rate of interest the private sector demands for holding state liabilities varies inversely with the size or total stock of those liabilities. For example, if the state wants the private sector to hold an excessive stock, the private sector will do that, but will demand a highish rate of interest for doing so. And what MMTers (and Milton Friedman) want/ed to do was cut the total liabilities to the point where the interest paid is zero: the the only liability is base money.

But having done that, it is then illogical or self-contradictory to say, as Navascués does, that “Responsable citizens would always prefer the state to issue debt, for transparency reasons. Even if it’s just to watch the trend in the yield curve for different maturities and how it is accepted by creditors.”

The whole point of monetising the debt is that there is no interest paid: the “yield curve” vanishes!

The external sector.

Next, Navascués says:

In the first place, there are not just two economic sectors. Apart from the ones mentioned, there is an external sector and whether it is a creditor or debtor is very important for the economy. If the external sector holds our country’s debt, the size of this can influence our creditors’ confidence depending on how we play the “simple” game of putting in and taking out money from the Central Bank to give to the private sector.

Good heavens! So some of the US national debt is held by China and Japan? My guess is the average street sweeper knows that.

But that does not alter my above points about QEing the entire debt. As purchasers of US national debt, the Chinese are investors in the great US of A, just as are USA based pension funds and the like. The Chinese will be influenced by the rate of interest paid on the debt just like pension funds.

There is of course the point that if any given country QEs it’s entire debt, as prescribed above, that will induce internationally mobile investors (like the Chinese) to seek better returns somewhere else in the world. In contrast, investors who are much more conservative and confine their investments to their own country will be likely to re-invest in the same country if the sell national debt.

So any country which QEs its entire debt will suffer more of a standard of living hit from those “mobile” investors re-allocating their investments than from the above “conservative” lot. But frankly most big investors nowadays are fairly international. For example the average UK based unit trust (“mutual fund” in US parlance) thinks nothing of switching investments from inside the UK to outside the UK or vice-versa. To that extent, Navascués’s “foreign sector” point does not materially affect the argument.

And that’s about as much as I’m prepared to read of Navascués’s article. He is clearly not desperately competent, and I do not have time for that sort of individual.

Friday, 24 March 2017

Thursday, 23 March 2017

Have NAIRU bashers now admitted defeat?

There was a fairly strongly worded exchange of views on the internet between roughly a week ago and six weeks ago between the folk who claim there is no relationship between inflation and unemployment (NAIRU bashers) and those who claim that there is a relationship, i.e. supporters of the basic NAIRU concept (which includes me).

I posted this article on this site. Plus there were at least two contributions on the mainly macro site, here and here. Plus there were at least two articles on Lars Syll’s site where I left comments.

Anyway, during the course of that debate I pointed out that one of the stranger claims by NAIRU bashers was made by Bill Mitchell (Australian economics prof) who claims the NAIRU concept is invalid, but who himself nevertheless finds the concept indispensable, so he gets round that by inventing his own term for the idea that there is some minimum level of unemployment which is feasible before inflation rises to unacceptable levels. His term is “inflation barrier”.

Well a few days ago he used the term again on his site in an article entitled “Amazing what politics does to people”. So I thought I’d enter the lion’s den so to speak, and suggest that it is a self-contradiction to claim the basic NAIRU concept is nonsense, and then invent your own term for the concept. My comment was as follows. I’ve put it in green italics.

“A fiscal strategy that restrains net public spending to keep the economy below the inflation barrier…”. So what exactly is this “inflation barrier”?

Presumably it’s the level of unemployment at which inflation becomes unacceptable: a concept normally referred to as NAIRU..!

The only difference between NAIRU and IB that I can see is that NAIRU specifically claims inflation “accelerates” when unemployment is below some level. But whether it accelerates or simply rises to some excessively high and FIXED level has always struck me as near irrelevant."

And what was the response from Bill and his merry band of followers? Absolutely none! Deathly silence!

So have NAIRU bashers finally admitted that there is actually a relationship between inflation and unemployment? Rather looks like it.

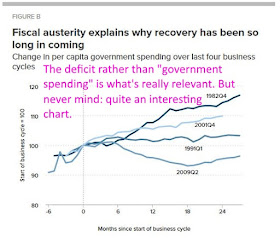

Having criticised Bill it must be said that he has done a brilliant job since the 2007/8 crisis in attacking the “pro austerity / cut the deficit” brigade.

And that raises a question, namely how can anyone be so disastrously wrong on one aspect of economics (and perhaps other subjects) while being brilliantly right on other aspects? It’s certainly a puzzle, and it’s a puzzle to which Paul Krugman has alluded. That is, Krugman once said that there are numerous economists he greatly admires. But in the case of almost every one of them he has found himself all of a sudden at some time or other reading something by one of those economists which he regards as complete and total incompetent nonsense.

Certainly that is a puzzle.